- Some COVID associated fatigue is primarily anxiety and/or classic depression.

- Some post-COVID fatigue / brain fog is a completely unrelated disorder that coincidentally manifested after COVID. Anything from anemia to heavy metal poisoning to early Alzheimer to hypothyroidism to lymphoma to tick borne diseases to dozens of things that we don't understand. Like fibromyalgia. The symptoms of fatigue and brain fog have a huge differential.

- True CAFS is all in the head. Specifically in the brain.

- Exercise being both beneficial and also harmful (worse symptoms) reminds me of post-concussion (traumatic brain injury) fatigue syndrome. Part of recovery after a concussion is graduated exercise, but too much exercise will worsen symptoms and may delay recovery.

- Lethargica encephalitic (epidemic 1917-1928, pathogen never identified), multiple sclerosis fatigue, Epstein-Barr associated fatigue syndrome, Lyme disease associated fatigue syndrome --- lots of infections are associated with persistent fatigue thought to be due to some form of brain injury.

- Fibromyalgia and what we used to call Chronic Fatigue Syndrome (the name keeps changing) are probably a similar mechanism to CAFS. We'd love to know if they were historically preceded by a circulating coronavirus infection other than SARS-CoV-2

- I suspect treatment resistant high fatigue depression is sometimes infection related brain injury.

Friday, September 29, 2023

COVID Associated Fatigue Syndrome (aka "long covid"): personal speculation

Tuesday, September 05, 2023

Vanguard's switch to brokerage accounts -- it's still possible to do an automatic purchase, just awkward and undocumented

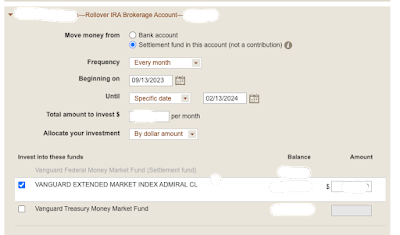

- Have cash in settlement fund. You no longer transfer directly from one fund to another. For example, in an IRA Rollover account, you first put cash into the Settlement fund then you setup an automatic purchase.

- You have to ignore this misleading 9/2023 verbiage from Automatic transactions: "Automatic investments allow you to move money from an authorized bank on file into an existing Vanguard account. If you'd like to move money to your bank or between your non-retirement and Vanguard Brokerage IRA, please use our automatic withdrawal feature." It omits that you can also move money between funds within a brokerage account. I suspect it's not been updated to reflect the changes Vanguard made with the brokerage account change.

Automatic exchanges are not available in a Vanguard Brokerage Account. I amsorry for any inconvenience this may cause....If you have additional questions, we can be reached at:https://support.vanguard.com/Sincerely,xxxxxxxxxRegistered RepresentativeVanguard Personal Investor

Of course Vanguard did not mention this when we asked about the consequences of switching to a brokerage account. In fact the representative I spoke with thought our prior exchange would continue to work.

The brokerage transition has also necessitated a redo of the Vanguard web site. It's now a mix of incomplete new functionality and old-looking but effective legacy functionality. They are obviously years behind schedule.

In the longer term I suspect Vanguard wants to reduce self-management of investments and earn a percentage on managing customer funds.

We had been planning to consolidate our investments with Vanguard. That's on hold now. The days of John Bogle are long past.

PS. It's also possible that Vanguard outsourced responses to an AI and the answer I got is actually wrong. It appears if one has cash in a settlement fund it's possible to setup an automated purchase. The web site text for automated purchases uses misleading language.