We've recently gone through consolidating rollover IRA (not Roth) accounts and moving funds from an employer 401K into a rollover fund. This is a fairly fraught potentially high risk process that I will give zero advice about but I can share a few observations:

1. It's surprisingly old fashioned. As in paper checks may get mailed! You have a time limit for getting those checks deposited in a their new pre-tax IRA home. The checks are typically written to be processed by the receiving fund. If you miss that limit you face a tax bill at the least. If the check is lost or stolen you may run into the time limit problem. This process was, to put it mildly, unsettling. We hated it.

2. The process often requires talking with a representative or two. I think this is intentional. Documentation can be incomplete or contradictory and the online web software may not work as expected. It's not that your stupid, it's them. Just assume you'll have to phone. (Our personal financial advisor warned us of this ahead of time. They were right.)

3. Representatives will try to upsell you on services. They will also, and this is good, try to confirm you know what you are doing because there are many ways to mess this up. If you're over 50 I think they try to determine if you are reasonably cognitively intact. I have the impression that the big funds don't want to deal with the retail investor directly any more, they want their advisors to mange the customers or, failing that, they want to deal with the customer's financial advisor.

4. There's an advantage to staying within a firm. Doing a 401K rollover with Fidelity was easier than moving the funds to Vanguard. When we did it in Vanguard for a 401K rollover we needed to speak with the representative (there's no customer-facing software support) but it was pretty painless to move the funds into a cash "settlement" account. (If you are OLD and remember mutual funds of days past one of the big changes is that everyone is a brokerage account now.)

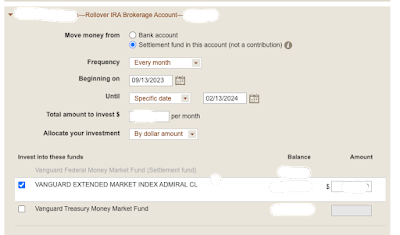

5. You probably want to move cash back into the market [1]. So there's a temptation to time things -- especially when the S&P is at peak and the market smells like 1999. Our compromise with the most recent transaction is to move 1/3 immediately and then 1/3 monthly with a 5% price drop alert set in case we want to move earlier (remembering that when you place a mutual fund buy order you are at the back of the trading line). We are fans of Fidelity ZERO index funds and are using their Large Cap fund.

- fn -

[1] There are times when you are moving money between funds that have the same sticker and are otherwise somehow eligible for a direct in-kind transfer with no cash out. I get the impression that's uncommon however.