I’ve been gnawing on this story for a year or two, figuring that sooner or later a real journalist would solve the mystery for me. That hasn’t happened, or perhaps Google’s increasingly lousy search results [1] just can’t find the article.

So it’s time for me to try to solve the mystery. Who killed broadcast (over-the-air, OTA) TV time-shifting in America?

Yes, there was a murder. Americans used to easily time shift broadcast television. From 1975 to through the 1990s we use VCRs (a marvelously complex device). In 1999 ReplayTV and TiVo introduced products that could digitize analog television and store data on an internal hard drive; early versions would even automatically delete commercials, which produced some tension. During the early 00s we saw many simple devices for digitizing analog signals, typically sold for under $100.

During this golden age of OTA time-shifting there was some serious tension— especially when ReplayTV auto-zapped commercials (and was litigated to death). A series of court cases walked a fine balance between consumer and corporate interprets. Then, around 2007, it all went to heck, and low cost time-shifting was doomed.

So what happened to change things in 2007?

The precipitating event was digital TV — after long delays it was coming to the US. Not just coming, but coming in high definition with an unencrypted signal that would be trivially easy to capture as binary MPEG — much easier than digitizing an analog signal or building a VCR. It costs only a few dollars to add recording to a digital TV (storage extra) [5], and a tuner and encoding device could profitable be sold for under $50 (storage extra). There was no easy way to prevent capture and HD res redistribution of an NFL game or a broadcast movie. This was disruption on a colossal scale, the same kind of disruption that transiently [2] broke the music business.

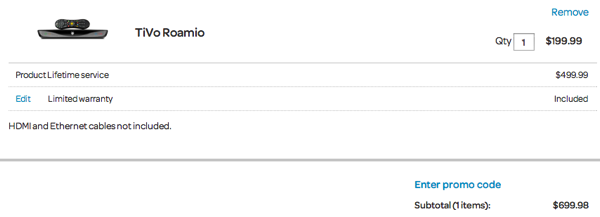

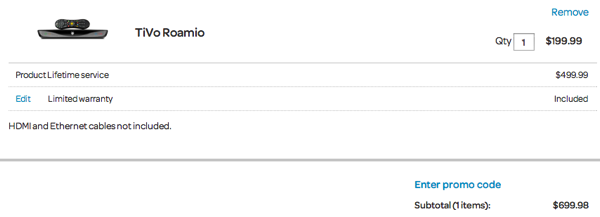

In this case impending doom focused minds - and, in America, the threat was crushed. As of May 2014 there’s exactly one company offering a quality OTA HDTV recorder, TiVo, and their current entry level product costs $700 [6]. Worse when TiVo goes out of business today’s devices will stop working (older devices will still work).

This surprises a lot of people who bought OTA DVR devices between 2007 and 2012. They think products like Elgato’s EyeTV are still sold. Well, they are, just not in the US:

Elgato does still sell products that stream to iPads; just not to a television — and they’re not the only ones. It’s the same story with devices like Simple.TV and Tablo. They may stream to an iPad or Android tablet [3], but direct connections to a TV are off-limits. There’s no HDMI out; Tablo’s excuse for the missing HDMI is amusingly coy. I assume there’s something about omitting a direct connection to a television that dodges the TiVo patent and “TiVo tax”. The only subscription-free devices I could find with HDMI out were the expensive and poorly reviewed Channel Master DVR+ (lousy tuner, and I suspect soon to sued into the ground) — and a rapidly iterating array of very low quality pure-China patent-dodging devices (sue them and they come back under a different name).

So murder was done, but we still don’t know who - and how. We know of at least 3 suspects with abundant motivation and shady records: Comcast/NBC, Viacom/CBS, and DIsney/ABC. All three had motivation, and the means of the US patent and legal systems….

Digital video recorder - Wikipedia, the free encyclopedia

On July 14, 2005, Forgent Networks filed suit[31] against various companies alleging infringement on U.S. Patent 6,285,746 [teleconferencing!], entitled “Computer controlled video system allowing playback during recording”. The listed companies included EchoStar, DirecTV, Charter Communications, Cox Communications, Comcast, Time Warner, and Cable One.

… Motorola requested that the United States Patent and Trademarks Office reexamine the patent, which was first filed in 1991, but has been amended several times.[32]

On March 23, 2007 Cablevision Systems Corp lost a legal battle against several Hollywood studios and television networks to introduce a network-based digital video recorder service to its subscribers.[33] However, on August 4, 2008, Cablevision won its appeal. John M. Walker Jr., a Second Circuit judge, declared that the technology "would not directly infringe" on the media companies' rights.[34] An appeal to the Supreme Court was rejected.

In court, the media companies argued that network digital video recorders were tantamount to video-on-demand, and that they should receive license fees for the recording. Cablevision and the appeals court disagreed. The company noted that each user would record programs on his or her own individual server space, making it a DVR that has a "very long cord."[34]

In 2004, TiVo sued EchoStar Corp, a manufacturer of DVR units, for patent infringement. The parties reached a settlement in 2011 wherein EchoStar pays a one-time fee (in 3 structured payments) that grants Echostar full rights for life to the disputed TiVo patents upon first payment(as opposed to indefinite and escalating license fees to be constantly renegotiated), and Echostar granted TiVo full rights for life to certain Echostar patents and dropped their counter-suit against TiVo.

In January 2012, AT&T settled a similar suit brought by TiVo claiming patent infringement (just as with Echostar) in exchange for cash payments to TiVo totaling $215 million through June 2018 plus “incremental recurring per subscriber monthly license fees” to TiVo through July 2018, but grants no full lifetime rights as per the Echostar settlement.

In May 2012, Fox Broadcasting sued Dish Network. Fox argued Dish's settop box with DVR function, which allowed the users to automatically record primetime programs and skip commercials, was copyright infringement and breach of contract. In July 2013, the 9th circuit rejected Fox's claims.

No, I can’t tell who won either — Wikipedia links out in a bewildering array of suits like including…

Sony Corp. of America v. Universal City Studios, Inc.

Sega v. Accolade

Cartoon Network, LP v. CSC Holdings, Inc.

CoStar v. LoopNet

Fox Broadcasting Co. v. Dish Network, LLC

My best guess is that the our “murder” suspects came to a mutual agreement with TiVo and other patent holders to build a solid patent wall - augmented by DMCA’s ability to block bypass solutions [8]. That patent collection and a limitless legal defense fund ensured the end of low cost OTA digital TV recording in the United States. The HD digital apocalypse was averted; at $700+ a device TiVo is no threat — it’s just a patent holder and patent licensor whose primary value is keeping a lid on OTA recording…

- TiVo Settles Patent Suits with Cisco, Google and Time Warner Cable | Variety … “The payments from Google and Cisco bring the total from awards and settlements related to the use of TiVo’s patents to roughly $1.6 billion, including previous deals with Dish Network, AT&T and Verizon, according to TiVo…TiVo entered into cross-licensing agreements with Google and Cisco and agreed to grant Arris Group (which acquired the Motorola set-top unit from Google) a limited license to four patents…

We have a body, motive and means — but only circumstantial evidence. With a bit of digging we could build a real case, but there’s a minor detail I’ve left out of the story.

The minor detail is that nobody cares - the victim was a homeless bum. Americans who don’t pay for Cable TV are either poor non-voters or relatively wealthy skinflint whackos - like us. Of the whacko cord-cutting skinflint contingent, only a small portion really want to do time-shifting. If not for our #1 son’s sports love we wouldn’t even bother with a TV antenna (the other kids watch iTunes rental movies once a week or so, I don’t watch TV at all).

So we’re talking a niche of a niche. Meanwhile there’s enormous economic pressure to turn broadcast spectrum into IP traffic - and end broadcast TV altogether. Sooner or later the market will find a way to do that; today’s DVR murder will be just a minor foreshadowing of the end of broadcast TV.

Still, it’s a fascinating story — to me at least. I love figuring out how “the system” solved the HD TV apocalypse - even if the results frustrated my family. Honestly it makes me feel better about global warming — complex adaptive systems can be extremely inventive.

In the meantime there’s a bit more story to play out. The combination of a Roku 1 ($50, HDMI) and Tablo TV ($210, no-HDMI) [7] will be interesting to watch — not least for the expected blizzard of lawsuits. Chinese manufacturers may improve the quality of their false-flag patent-dodging devices. MythTV might revive (announcements stopped 9 months ago), or maybe small businesses will sell Raspberry Pi solutions. Perhaps niche manufacturers will split the “smart” TV; a standalone digital tuner with HDMI output to receiver and downstream display and sound would make it much easier to hack a DVR into the mix …

See also

- fn -

[1] Another story that’s not been told. Is it just me, or is Google search really going South? If so, why?

[2] And therein is a lesson about managing disruption. Sure, the music business was on the rocks — but then file sharing services were slowly beaten into the ground. At the same time CDs started to disappear, as first digital downloads and then streaming took over. With CDs gone and file sharing essentially crushed, revenues are set to return. Streaming prices will rise, DRM may return to downloads, and the disruption will be history.

[3] Walmart now sells a 7” tablet for $70.

[4] $300 on Amazon for a device that should cost a fraction of that price. I assume much of that is patent fees.

[5] Our Samsung Smart TV ships with a USB connector for external storage and a remote with a record button - both disabled in the US.

[6] Yes, $700, as below. Of course it’s usually sold with a mandatory subscription, so this cost is paid out over a few years. The initial retail price is only a downpayment. One teardown estimates the TIVo Roamio costs $170 to make, but of course most of us would be happy with a less deluxe advice. We don’t know how much money TiVo pays for patents or to run their listing service.

[7] Canadian, which may help with the expected litigation. Tablo can be used without a subscription, so although it’s far more expensive than it should be for our purposes, the combined cost of Roku and Tablo is still less than 1/2 the cost of a TiVo. I suspect much of the cost is direct patent fees and costs secondary to patent workarounds.

[8] DMCA made it illegal in the United States to interfere with an encryption chain; I suspect that law prevented some patent block workarounds.

Epilogue

Some people solve Rubik’s cube. That never interested me much; I like to puzzle out this kind of story. I think I’m done gnawing this bone, but if I find a better discussion of what happened I might add some updates. Meanwhile I’m looking for pre-2010 Elgato and TiVo devices — I may even try a Hauppage Windows device in a VM.