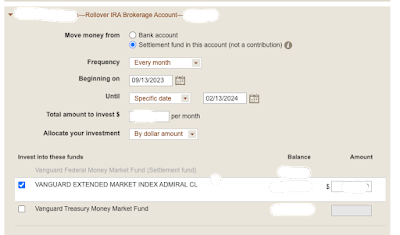

- Have cash in settlement fund. You no longer transfer directly from one fund to another. For example, in an IRA Rollover account, you first put cash into the Settlement fund then you setup an automatic purchase.

- You have to ignore this misleading 9/2023 verbiage from Automatic transactions: "Automatic investments allow you to move money from an authorized bank on file into an existing Vanguard account. If you'd like to move money to your bank or between your non-retirement and Vanguard Brokerage IRA, please use our automatic withdrawal feature." It omits that you can also move money between funds within a brokerage account. I suspect it's not been updated to reflect the changes Vanguard made with the brokerage account change.

Automatic exchanges are not available in a Vanguard Brokerage Account. I amsorry for any inconvenience this may cause....If you have additional questions, we can be reached at:https://support.vanguard.com/Sincerely,xxxxxxxxxRegistered RepresentativeVanguard Personal Investor

Of course Vanguard did not mention this when we asked about the consequences of switching to a brokerage account. In fact the representative I spoke with thought our prior exchange would continue to work.

The brokerage transition has also necessitated a redo of the Vanguard web site. It's now a mix of incomplete new functionality and old-looking but effective legacy functionality. They are obviously years behind schedule.

In the longer term I suspect Vanguard wants to reduce self-management of investments and earn a percentage on managing customer funds.

We had been planning to consolidate our investments with Vanguard. That's on hold now. The days of John Bogle are long past.

PS. It's also possible that Vanguard outsourced responses to an AI and the answer I got is actually wrong. It appears if one has cash in a settlement fund it's possible to setup an automated purchase. The web site text for automated purchases uses misleading language.