My home state of Minnesota, most annoyingly, uses caucuses. I attend the Dem variety in the bluest of neighborhoods. They are crowded, disorganized and well meaning. When I ride my bike to caucus cars slam to a stop as though I were a family of 5 on foot. Which is wrong and dangerous, but I appreciate the sentiment.

The Dem caucus is not representative of the Dem voter. You have to be very persistent to fight through traffic and crowds to hit the narrow window for voting. Only the most committed can get there. The caucus system is a bad, bad idea. I think the same is true of the GOP caucuses here.

So the caucus results last night were not too surprising.

The GOP, as usual, went for the extreme right candidates. This year there were three of ‘em - Trump, Rubio and Cruz. Since we have one of the strongest economies in the US, with unemployment under 5% for years, Trump didn’t have his usual vote-of-despair left-behind advantage. So the three extremes ended up with fairly similar numbers, but the anti-Trump movement focused on Rubio and he won.

My team went, as usual, for the more left candidate. Sanders won by 20%, so he might even have won a primary. I voted for HRC, but the MN DFL is effectively to the left of me — which is saying a lot.

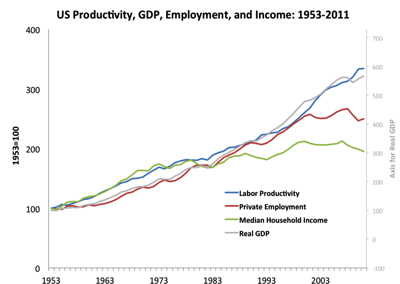

I’m backing HRC but, in truth, we need to go down some variation of the Sanders road over the next two decades. We’re going to have to bias the post-AI globalized economy to generate jobs for the non-college — even at the cost of economic efficiency. We have to build more social supports for people who aren’t working, with some kind of rethinking of what we do for disabled workers. We may end up with a non-binary definition of disability, or even some kind of guaranteed income.

We will end up taxing wealth in one form or another and we’ll do a lot more government redistribution. We should also, and this is not so much Sanders, execute on the old Gore “reinventing government” mission, refactoring regulatory systems. We need to break the accounting, tax and regulatory frameworks the mega-corporations (“neo-Chaebol is a term I like) have built; the foundations of a great stagnation ecosystem wherein new companies are built only for acquisition.

We need to build supports that enable entrepreneurial types to pick business designs off a shelf and implement them. We need to strip benefits from employment completely, and both fix and finish the mission the ACA started — while breaking the corporatization of that great compromise.

Phew. It’s a big mission, but it is doable. We have to do it, or we get President Trump. Or worse. Sooner or later.

So I don’t feel that bad that Sanders won Minnesota. It’s a good sign for the future. I don’t want him to go up against the GOP though. By the time their attack machine is done with him he’ll be hiding in a stone shelter in the wilderness. HRC’s great strength is she’s lived that machine for decades. Nobody short of Obama can equal that. (And, of course, I would love him to keep his job. Alas, even if our constitution allowed that I think he’s ready for a change.)

See also:

- The AI Age: Siri and Me 12/2011

- Causes of the Great Recession: China, GPSII and RCIIIT. Now for Act III. 4/2010. Holds up pretty well, but I now add a third somewhat related factor of a mega-corp created environment that’s toxic to the startups that historically create employment.

- Amerisclerosis? Why US underemployment (and probably inequality) persists 9/2013. Secular stagnation is the current term.

- Mass disability goes mainstream: disequilibria and RCIIT 11/2011. In the new age there jobs for the high EQ/IQ. Others are not so needed.

- Ants, corporations and the great stagnation 12/2011

- Causes of the crash of ’08 - how much fraud? 2/2009. Good to look back, but I know think these were secondary causes. For example, IT enabled complexity and complexity enabled fraud.

- Civilization is stronger than we think: Structural deficits and complex adaptive systems 5/2010. Trumpism is scary, but it’s also the way the “meta-mind” approaches big hard changes.

- Donald Trump is a sign of a healthy democracy. Really. 8/2015. The problem of the unwanted non-college (“working class”) isn’t going to be solved by more education. Remember, the non-sentient AI revolution will come for you too.

- For American adults are poverty and disability the same thing? 10/2013. I think this is true for white and asian men in America, for others racism also drives poverty. (I mention this at the end of the post but should have had it up front.)